Comparison of license fees for setting up

an eGaming company in different jurisdictions

License fees can be divided into several categories that vary depending on the jurisdiction. Usually there is an initial set up cost, annual cost, monthly fees, and possibly a host of other expenses depending which kind of licenses and for which country it is applied to.

In addition to this the companies are often subject to increased rate, or a lump sum, of tax or fees should their revenue exceed certain thresholds. Some jurisdictions levy VAT, import duty, corporate taxes and other fees on top of this, while others opt for a simpler system which covers all expenses through a single tax bracket.

In addition to this the companies are often subject to increased rate, or a lump sum, of tax or fees should their revenue exceed certain thresholds. Some jurisdictions levy VAT, import duty, corporate taxes and other fees on top of this, while others opt for a simpler system which covers all expenses through a single tax bracket.

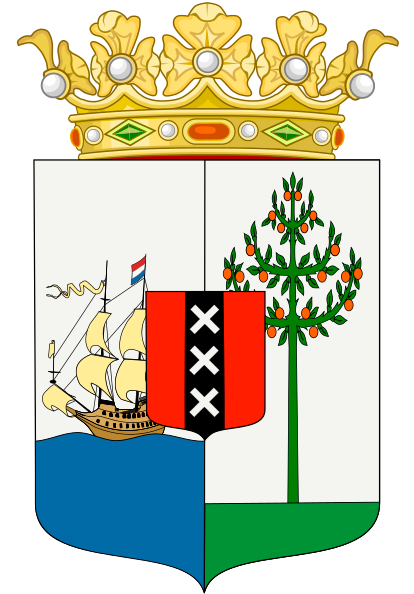

Curacao

- Initial licensing process takes 2 to 4 weeks.

- Online casinos can apply for an eZone permit, which comes with 0% tax on gross bets, no VAT, no import duties and only 2 % tax rate on net profits.

- One time set up cost of 10 000 euro.

- Monthly license fees of 4 300 euro for the first two years, after this negotiable.

- One license covers all approach, with possibility to provide sub-licenses.

United Kingdom

- Initial license processing takes of 12 to 16 weeks

- Application fee of 2 000 to 60 000 pounds per license and depending on category.

- Annual fee of 2 000 to 155 000 pounds per license and depending on category.

- 330 pound license fee for staff members.

- 15% gaming tax on gross profit.

- 7 different license categories.

Isle of Man

- Initial licensing process takes 10 to 12 weeks.

- Gaming duty of 0.5 to1.5% on gross profit depending on gross income.

- 15% flat duty for pool betting.

- 0% corporate tax rate.

- Application fee of 5 000 pounds.

- License fees of 35 000 pounds per year for the first five years.

- Company must have 2 local directors and be based on the Isle of Man.

Malta

- Initial licensing process takes 12 to 16 weeks.

- Corporate tax of 5 to 35%.

- Initial application fee of 2 330 euro.

- Yearly license fee of 8 500 euro.

- License renewal fee of 1 500 euro.

- Minimum initial capital required for company 40 000 to 100 000 euro depending on six different license categories.

- Multiple licenses require cumulative capital.

- Monthly fees of 2 330 euro to 7 000 euro per month, depending on license category.

- Fees capped at 466 000 euro per annum per license, excluding taxes.

Gibraltar

- Extremely extensive and time taking initial vetting process.

- Initial yearly license fee of 2 000 pounds, with renewal yearly at the same price.

- Gaming tax of 1% on gross profit, and an additional 1% tax on gross product.

- 10% corporate tax rate.

- No VAT.

- Minimum annual tax of 85 000 pounds.

- License duration one year.

- Most online casinos are required to have a proven tracks record and software needs to undergo rigorous testing.

- 7 different license categories.